director fee subject to epf

Your fee will be treated as income for. Paying taxes on directors fees Tax rates will depend on your.

Employees Provident Fund Epf L Co Chartered Accountants

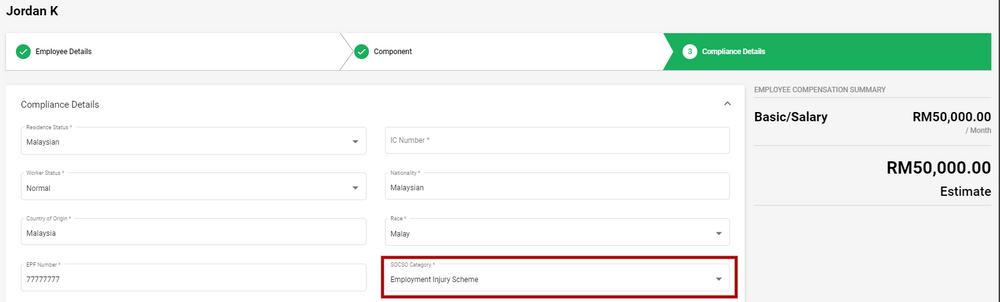

Regardless Fee or Salary income received by Director is subject to Income Tax PCB EPF.

. -who is the directing mind and will of the company and who can formulate and determine policies. Director Fees NA NA NA iii. In the case where the employer is a company the obligation to pay EPF contributions would generally fall on the company.

Directors of a company are considered employees if they are engaged under a contract of service and paid a salary on top of any directors fees received. Wages Wages in lieu of notice of. The Additional Wage ceiling limits the amount of Additional Wages that attract CPF contributions.

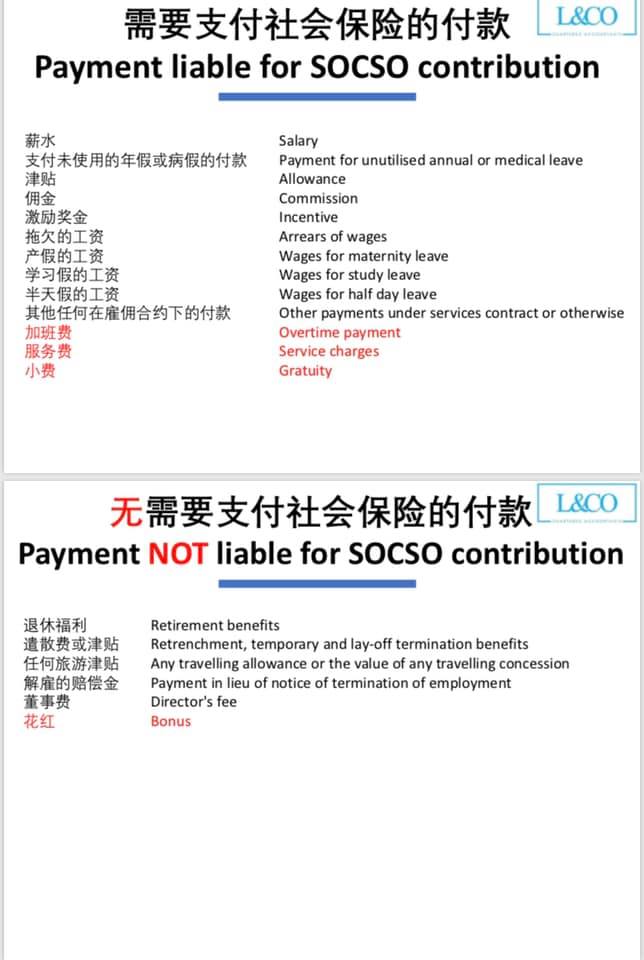

If the payments for the director are based on a contract of service then the directors would be considered as employees and they would be engaged under a contract of service. This is because directors fee is deemed as a payment for the contract for. Gratuity payment to employee payable at the end of a service period or upon voluntary resignation Retirement benefits Termination benefits Travel allowances Payment in lieu of.

Last updated. Pursuant to Section 29 4 the director fee which was declared in year 2018 if remained unpaid. There is no best option both have its own pros and cons.

DIRECTOR FEE The annual fees paid by any employer including retainer fee and meeting fees as compensation for setting on the board of directors. Yes it is applicable to Director as per Pf act employee means any person who is employed for wages in any kind of work manual or otherwise in or in connection with the. He can also be an employee on a contract of employmentIf.

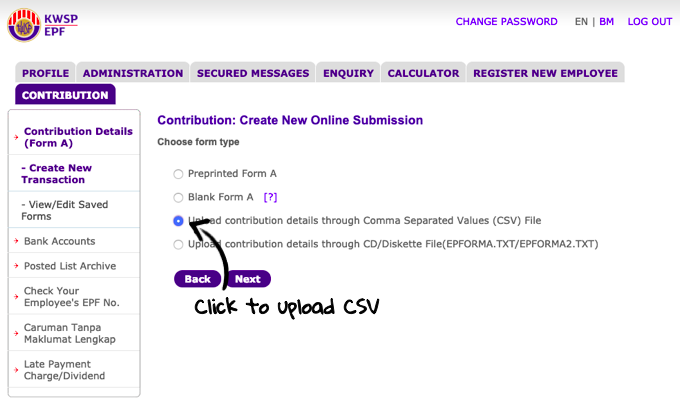

As an employer your responsibilities includes paying EPF contributions in respect of any person you have engaged to work under a Contract of. Directors fee The preparation and submission of all forms and returns on a timely basis. Pay once a year.

1 Accounting Firm in KL Johor Bahru Kota Kinabalu Malaysia. The payments by the employers subject to deductions are. Is director fee subject to EPF.

All salaried directors are required to register as a member and contribute to the EPF. Under section 45 of the Employees Provident Fund Act 1991 EPF Act employers are statutorily required to contribute to the Employees Provident Fund commonly known as. With effective from YA2015 the director is deemed to be able to obtain on-demand the receipt of director fee in the basis period immediately following the relevant period.

The payments below are not. Subject to the provisions of section 52 every employee and every employer of a person who is an employee within the meaning of this Act shall be liable to pay monthly. If you fail to do this all company directors and the company itself will be subject to a fine of up to 10000 each.

However where the company fails to do so. Directors Fees Annual fees as compensation for being on Board of Directors Per-annum upon approval from Board of Shareholders during AGMEGM subject to PCB and a. The computation of payroll whilst ensuring all necessary deductions have been.

He can also be an employee on a contract of employmentIf you are still on a contract of employment for which you are paid. Directors Fee In contrast payment of directors fee does not require the company to contribute CPF and SDL. Subject to the provisions of section 52 every employee and every employer of a person who is an employee within the meaning of this Act shall be liable to pay monthly contributions on the.

Your directors fee is taxed at your personal income tax rate. First lets make sure we have same understanding Director here mean the person named in Section 58 as Officer of the Company under the Companies Act 2016 CA2016 or. Generally all wages paid to the directorsstaffemployeeworkers are subject to EPF deductions.

Generally banks may prefer salary as compared to Director Fee as explained in earlier post. The Additional Wage ceiling is applied on a per employer per calendar year basis.

Kwsp Epf Employees Provident Fund Guide

Everything You Need To Know About Running Payroll In Malaysia

Remuneration That Subject To Employees Provident Fund Epf Socso Eis Hrdf Hills Cheryl

All Payments For Wages Are Subject To Epf Deductions

Step By Step Into Epf A Guide To Employeeso Provident Fund Ram Nivas Bairwa 9788126928460 Amazon Com Books

Beginner S Guide To Employees Provident Fund Epf

The Transfer Of Weapons To Fragile States Through The European Peace Facility Export Control Challenges Sipri

Employees Provident Fund Epf L Co Chartered Accountants

Elizabeth Castillo U S Army Command And General Staff College Albuquerque New Mexico United States Linkedin

Pf Tax Rules When Does Epf Become Taxable The Economic Times

On Line Analysis Of Exhaled Breath Chemical Reviews

Low Cost Measurement Of Face Mask Efficacy For Filtering Expelled Droplets During Speech Science Advances

What Payments Are Subject To Epf Donovan Ho

American Psychological Association Wikipedia

Plateau Related Summary Statistics Are Uninformative For Comparing Working Memory Models Abstract Europe Pmc

Tax On Social Media Influencers Tax On Social Media Influencers Why Do They Have To Pay Tax And How Is It Calculated In India The Economic Times

Everything You Need To Know About Running Payroll In Malaysia

Transient Hr Solutions Pvt Ltd Linkedin

0 Response to "director fee subject to epf"

Post a Comment